What is Event Trading?

By Kevin Wolff

Updated:

As the popularity of gamification continues to grow, event trading is on the rise as one of the most exciting ways to invest. Event-driven contract trading is a federally regulated industry, and it’s available for eligible users in most US states and Canadian provinces. There are several trusted online platforms available for legally trading on events, and this page will cover everything new users need to know about event trading including how to trade, the best trading strategies, and other important information.

Event Trading: How It Works

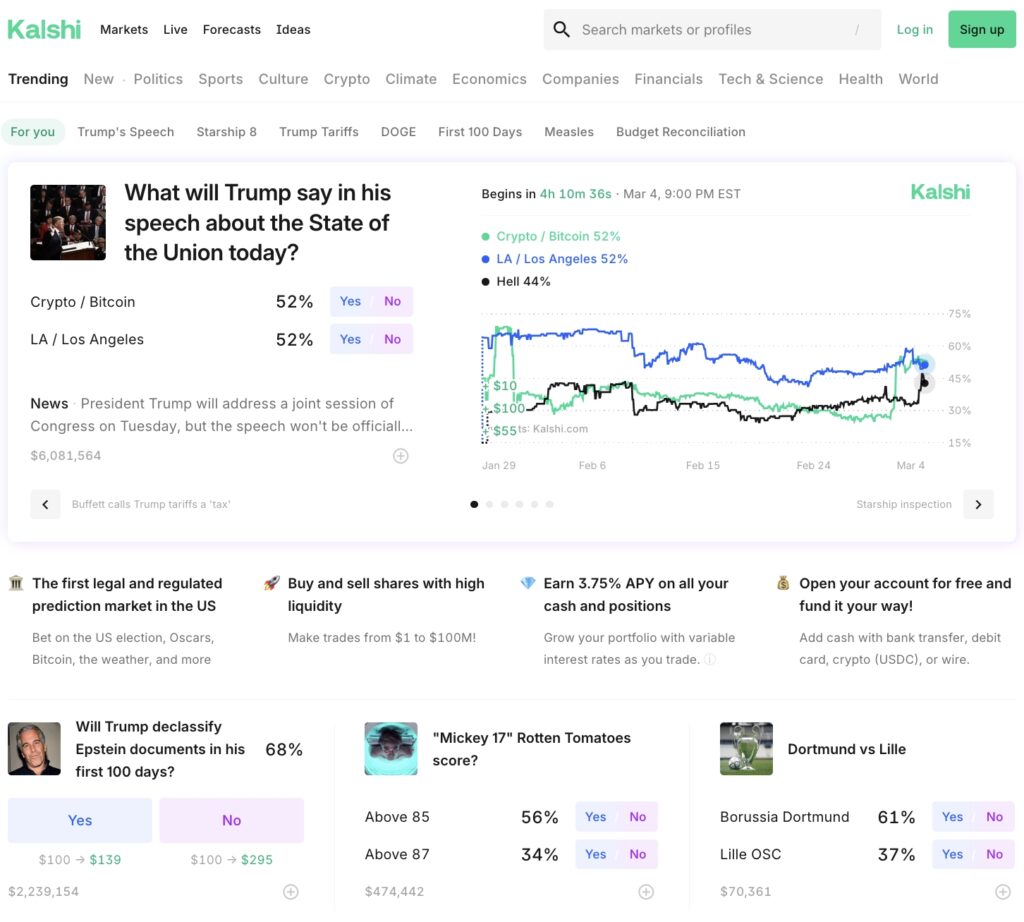

If you’re familiar with platforms like Kalshi and Polymarket, you’ve likely heard the term event trading before, but what exactly is it? To make it as simple as possible, event trading is staking a yes or no position on the potential outcome of a future event. The event trading industry is federally regulated by the Commodity Futures Trading Commission (CFTC) so it’s a totally legitimate way for users to invest.

The yes/no outcomes of the events in question are called event contracts, and they allow the user to profit from making a correct prediction. Users who correctly predict the outcome of the event will keep the full value (profit) of the event contract. Prices for the yes/no sides of the contracts are dictated by the likelihood of the event outcome. The yes/no prices will fluctuate, allowing users to buy and sell their positions for profit even before the outcome of the event.

Event contracts are available across a wide range of categories including politics, financial markets, weather, economics, sports, health, science, tech, culture, and more. As it currently stands, event trading is legal and available on multiple platforms in all 50 US states and is also available in Canada.

To give an example of an event contract, users could buy and sell on yes/no outcomes for the question: will it rain today in Los Angeles? The price of each outcome will be dictated by the probability of rain, and users can buy and sell on those yes/no outcomes. Then, traders simply wait and see which side of the contract wins out.

If it does rain in Los Angeles on the given day, those who purchased the yes outcome will win the full price of the contract. If it does not rain in Los Angeles on that day, those who purchased the no side will be paid out the full contract price.

While that simple example outlines the basic fundamentals of event trading, there are several event driven trading strategies that can be utilized by both new and experienced bettors to further enhance their abilities.

How to Trade Event Contracts: Best Event Trading Strategies

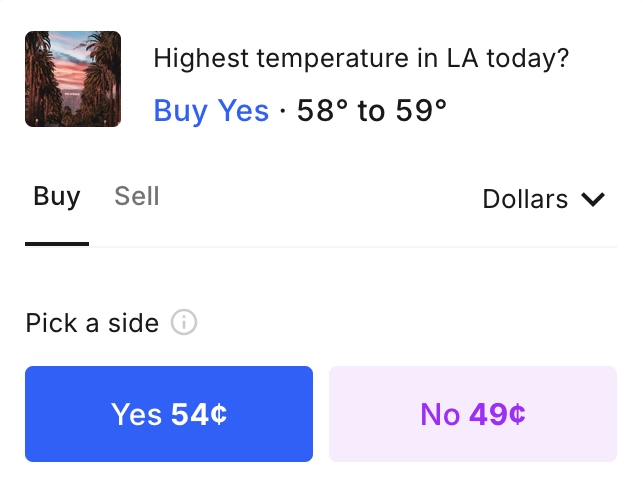

When it comes to trading event contracts, there are multiple ways to approach buying and selling these yes/no outcomes. For beginners and newer bettors, it may be best to dip your toes into the event trading action by utilizing quick orders to buy and sell contracts. Experienced traders may want a bit more control of their environment, and they can utilize set-price orders when they buy and sell event outcomes.

Best Event Trading Strategy for Beginners: Quick Order

The easiest way for new users to get started with event trading is to simply buy and sell contracts at the given market prices. This strategy is often referred to as a quick order, and the trade is executed immediately. When utilizing quick orders, the trader is buying or selling contracts at the best available market price, but it’s not guaranteed that all trades will be executed at that same price, as there may be a limited amount of available contracts.

Users should not be alarmed if they put in a quick order for 100 contracts and find that 70 of the contracts are worth $48 while 30 of the contracts are worth $47. This is simply the platform executing the trades at the best available prices given the status of the market.

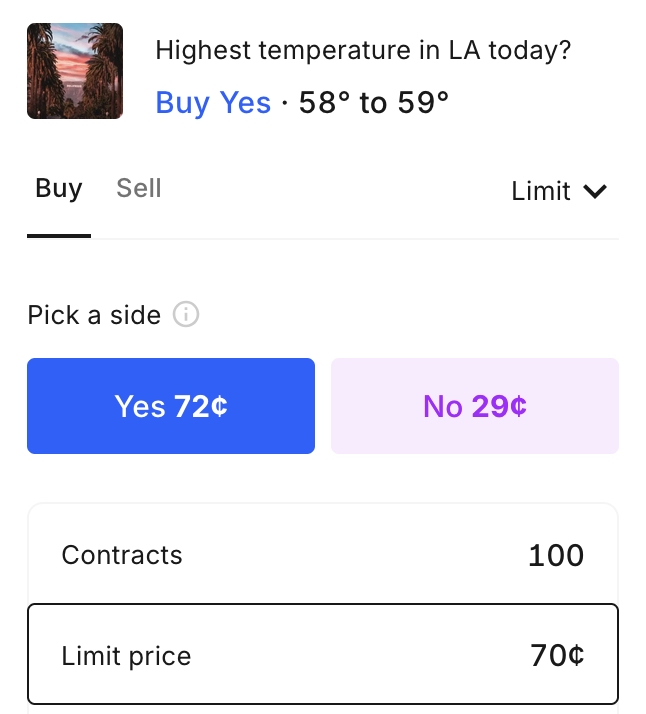

Best Event Trading Strategy for Experienced Users: Set Price Order

For those who have a bit more experience trading event contracts, it might be a better strategy to opt for a set price order, also known as a limit order. This trading method allows the user to have more control over the transaction, as they are setting the price that they will trade the event contracts at. Rather than just taking the best available market price like a quick order, users will select the price they wish to trade at.

Set price orders, or limit orders, are not always executed instantly as it’s possible there are not any available contracts at the set price. It’s also possible that the trade will never occur at all if contracts at the set price are never available. However, it’s guaranteed that the trade(s) will only be executed at the price designated by the user.

Selling Event Contracts Early: Protect Against Unexpected Outcomes

Users who correctly stake the yes/no side of an event contract are paid out the full value of the contract upon the conclusion of the event. However, this is not the only way to profit from event trading. Investors also have the option to sell their position prior to the event playing out, and they can rake in a profit if the market has moved in their favor since the time when they initially purchased the contract(s).

To give an example, let’s say you purchased the yes side of a contract at $50. If the probability of the yes outcome increases, so too will the price of those contracts (ahead of the event occuring). If the price of a yes contract increases past $50, you would have the option to sell your $50 yes contract at the new price, let’s say it’s $58, and you would keep the difference (profit) of $8. This strategy of selling your positions early can help protect against the risk of unexpected event outcomes.

Event Trading Investing vs. Event Contract Trading

Contract trading was borne out of the stock market, and while event contract trading and event trading investing sound similar, they’re quite different.

Event trading investing is a specific term referencing trading that aims to take advantage of temporary stock mispricing. Those mispricing are usually connected to an event, such as a sale or other corporate transitions.

Event contract trading works more like a futures betting market, as you’re investing in the outcome of a future event, such as the weather, the NBA Champion or winner of the presidential election.

They can certainly cross paths, as financial market outcomes are available at most event contract trading sites, but in this case, you’re not buying actual stocks.

Event Trading Categories

One of the most attractive aspects of event trading is the wide variety of categories for users to buy and sell contracts for. Gamification is at an all time high throughout society, and event trading offers the ability for investors to profit on real life outcomes in fields all across the globe.

Some of the popular event trading categories include:

- Politics

- Financial Markets

- Sports

- Weather

- Economics

- Health

- Science

- Technology

- Culture

Event Trading Platforms

Users have several platforms available to trade event contracts, and these federally regulated platforms offer a wide range of event trading possibilities. Three of the extremely popular event trading platforms include Kalshi, Crypto.com, and the Chicago Mercantile Exchange (CME).

Kalshi

Kalshi is making waves in the event driven investing space as one of the breakthrough new platforms for traders. Available in 44 states (excluding Illinois, Maryland, Montana, New Jersey, Nevada, and Ohio), Kalshi offers event trading across a variety of popular categories including sports trading, financial trading, as well political event trades, to name a few. Event trading contracts on Kalshi total $1 each. Kalshi saw a massive influx of users for betting on Super Bowl LIX, as it provided the ability to wager on the NFL’s championship in all 50 states, unlike legal sportsbooks. Kalshi also offered trading capabilities for the 2024 US Presidential Election, which was not permitted on legal US sportsbooks.

Crypto.com

Users can enjoy sports trading capabilities on the Crypto.com platform. Sports is the only available event trading category on Crypto.com, and contracts total $100 each for yes/no outcomes of real world sports events. Crypto.com event trading (for sports) is accessible on both the Crypto.com website, as well as the mobile app which can be downloaded on iOS and Android devices.

Chicago Mercantile Exchange

The Chicago Mercantile Exchange (CME) was one of the first available event trading platforms, and specializes in the financial markets. Users on the CME have the option to trade event contracts pert

After years of writing as well as Data Analyst work for Pro Football Focus, Kevin Wolff is now a Sports Betting Writer for SportRadar, and more specifically, SBD. A graduate of Fordham University in NYC, Kevin is also a full-time dog dad when he's not writing.