Best Betting Strategies for Hedging Your Sports Bets

By Aaron Gray

Updated:

Hedging is a method used to either reduce your risk or guarantee a profit when betting on sports. Fundamentally, hedging is a risk management strategy to help you minimize losses and maintain a healthy bankroll.

While hedging bet can seem like a challenging strategy to master, the concept is simple. Hedging involves placing a second bet on a different outcome than your original bet. Depending on the scenario, this approach can secure profit regardless of which outcome occurs or reduce exposure on your initial bet. In the end, the goal is always to limit potential losses.

When Should You Hedge Your Bets?

- When doing so allows you guaranteed profit betting on a sporting event

- To mitigate your losses and reduce bankroll exposure after placing a riskier bet

- When you’ve made an accidental bet

Easy-to-Understand Hedging Examples

Let’s take a moment to understand the concept behind a hedge. In essence, a hedge is any action taken to reduce the risk of a damaging outcome occurring in the future.

Car insurance is a great example. Mandatory in every US state (except New Hampshire), car insurance is a hedge which protects car owners against the financial burdens of getting in a car crash.

Here’s the thing: insurance is expensive, and it’s entirely possible that you could drive your entire life and never need to use it. So, would most people still buy insurance if the government didn’t make them do so? Probably.

Most people would rather swallow the predictable cost of insurance to protect themselves from the massive financial loss of getting in a car accident. In essence, you’re making a recurring small bet with your insurance, and it protects you from the low probability (but high cost) event of getting in an accident.

So, how does this relate to sports betting?

Let’s say you place a massive first bet with long odds and later realize you have exposed yourself to an unacceptable level of financial risk similar to, say, getting in a car accident. You can place additional bets on opposing outcomes to reduce this exposure. These opposing bets act as your insurance policy, or your hedge.

What Does Hedging Mean for Sports Betting?

There are a lot of different scenarios where sports bettors can secure a profit by exercising the appropriate hedging strategy. We’ll take you through some specific examples below.

Profiting on Playoff Futures with Hedging

If you hedge your bets carefully, betting on a playoff series is an easy way to guarantee a profit.

For example, let’s say you’re betting on hockey and the Pittsburgh Penguins are playing the Columbus Blue Jackets in the first round of the NHL playoffs. You liked the Blue Jackets’ chances, so you bet on them as the heavy underdog at +400.

Say the Blue Jackets went up 2-0, and were heading home to play games 3 and 4. As a result, Pittsburgh’s series betting odds became a lot longer than they initially opened, moving to -100. At this point, you could place a $200 bet on the Penguins to win the series, and you’d be guaranteed a profit no matter what.

If the Blue Jackets come out on top and your original bet wins, you’d win $400 on top of your stake (minus the $200 you wagered on the Penguins). You’d be guaranteed $200 in profit!

If the Penguins are victorious, making your hedge bet the winner, you’d win $200 (losing the $100 you wagered on the Columbus Blue Jackets). You’d still be guaranteed a profit of $100!

Of course, you could just wager $100 on the Penguins, and by doing so, secure yourself from any potential losses while maximizing your return if the Columbus Blue Jackets won. If the Jackets managed to win the series, you’d win $400 (minus the $100 you bet on the Penguins). It wouldn’t secure you a profit, but you wouldn’t cut into your potential profits to a significant degree either.

As a bettor, it’s up to you to decide what you’re comfortable with in this scenario. If you’re a risk taker, and entirely confident in a Blue Jackets victory, you might not want to hedge at all. If you’re a bit more conservative in your approach and are looking to protect your bankroll, hedging is the smarter play.

Hedging with Championship Futures

Futures wagers are a great way to lock in profits with hedging.

Let’s look at NFL futures. In this hypothetical, the Chiefs open at +5100 the day after the Super Bowl (maybe Patrick Mahomes retired unexpectedly?). If you wagered $100 on them on that day, and they make another run to the Super Bowl the following year, you’re looking at a potential profit of $5,100.

Meanwhile, the Eagles are -200 on the moneyline the night before that hypothetical Super Bowl, and you want to make sure that you at least break even. If you wagered $2,000 on the Eagles, you’d stand to win $900, no matter what ($1,000 profit minus the $100 you wagered on the Chiefs). Had the Chiefs won, you’d have been guaranteed $3,100.

Hedging Parlays

Many bettors hedge to ensure guaranteed profits when they place parlay bets.

Say that you’ve placed a parlay on the moneyline of four Sunday football games. Its 6PM and three out of the four teams have covered. The final game in your parlay is going to kick off within the hour with your winning parlay still in play.

At this point, you can wager against the team you bet on in your parlay. While live betting is an option, that could make it too late to get the best betting odds available for your hedge bet.

If the last game in your parlay was Seattle vs. Philadelphia and you bet on Seattle in your parlay, you could place a separate bet on Philadelphia to secure a profit. If Seattle wins, you’ll hit your parlay and profit, minus whatever you wagered on Philadelphia. If Philadelphia wins, you’ll profit and only lose your parlay wager.

Of course, the amount you’d need to wager in order to secure a profit would depend on the specifics of the moneyline odds in your parlay.

Hedging to Mitigate Your Losses

If you’ve lost confidence in your initial wager, hedging can reduce your exposure to losses. Betting on the opposite side of your original wager acts as an insurance policy.

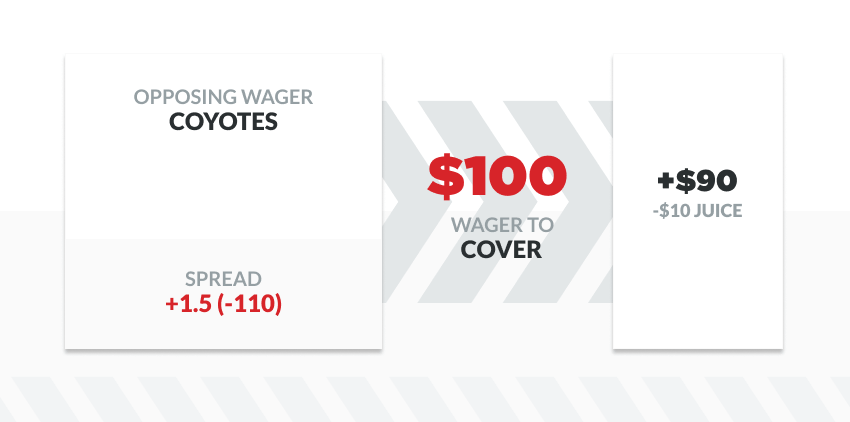

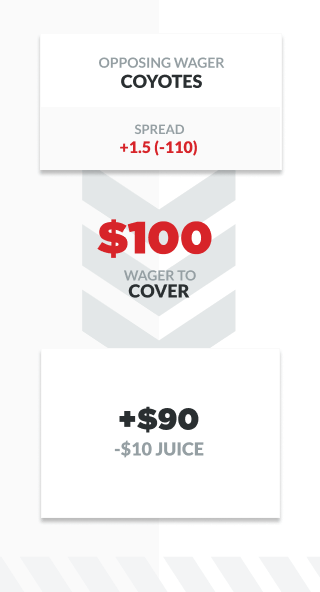

Say that, earlier in the week, you bet $100 on the Canucks to cover the spread of -1.5 at (-110) to beat the Coyotes. However, by the time Saturday night rolls around, the Canucks lost three key players to injury, and their starting goalie was mired in a horrible slump.

These events would understandably cause you to lose faith in the Canucks’ ability to cover the spread. As such, you’re no longer comfortable with placing $100 on this being the outcome of the game.

You could hedge your bets in two different ways. Let’s say the opposing wager, the Coyotes at +1.5, is listed at (-110). You can wager $100 on the Coyotes to cover the spread, in which case you’d be guaranteed to win $90. You’d only lose the $10 on the juice.

Additionally, you can make a partial hedge bet. This way, you can reduce the overall size of your bet on the Canucks. By wagering $77 on the Coyotes (with your initial $100 bet still open on the Canucks ).

If the Canucks covered in this scenario, you’d still come away with a $13 profit, as you’d net $90 in profit, minus the $77 you bet on the Coyotes. If the Coyotes covered, you’d lose $30. You’d win $70 while losing the $100 you wagered on the Canucks.

There are tons of combinations you can choose for your hedges, depending on the exposure you’re comfortable with.

Taking Back an Accidental Bet

While it’s not very common, we’ve heard many stories of accidental bets being placed. Once you’ve staked a wager, it can’t be rescinded.

So if you’ve made a bet by accident and don’t believe it’ll be successful, hedging allows you to reduce your exposure instantly. Just bet on the opposite outcome, and all you sacrifice is the sportsbooks’ juice.

For example, say you mistakenly wagered on the total of an NBA game. Simply bet the same amount on the under, and you’ll only incur a small loss either way.

Hedging Formulas

Deciding when to hedge is inherently cloudy territory. However, these two formulas can help you calculate how to prevent a loss and secure maximum profit via hedging.

Formula for Preventing a Loss by Hedging

The formula for hedging to prevent loss is simple. Since we know how much we want to make, it’s a matter of manipulating the formula for calculating profit from decimal odds. In the end, you just divide your original stake by the hedge decimal odds minus one. Consider this a hedging calculator of sorts:

Hedge Stake = Original Stake / (Hedge Decimal Odds – 1)

For example, say you bet $100 on the Jaguars to win the Superbowl at (+1000) early in the season. However, they’re up against the Patriots in the Super Bowl. The Patriots are listed at (-200). You’ve decided you want to guarantee you make your money back.

The formula for hedging to prevent loss is simple … Just divide your original stake by the hedge decimal odds minus one.

You’d need to convert American odds to decimal odds before you can make the conversion.

Initial Stake = $100

Patriots Odds to Beat the Jaguars = 1.50

100/1.50 = $200

If you bet $200 on the Patriots, you will receive all of your money back, no matter the outcome. A Patriots victory secures you $100, covering your initial stake on the Jaguars.

Plus, you still stand to profit immensely should the Jaguars win.

Formula to Maximize Winnings with Hedging

This formula is slightly more complicated than the last, but will ultimately save you time if you ever find yourself in an advantageous hedging situation.

The formula is as follows:

X = (P + W1) / O

P = Profit you stand to acquire on your first wager

W1 = The $ amount of your first wager

O = Decimal odds of the wager you are using as a hedge

To calculate how much you’re going to win, simply subtract x (the amount you placed on the hedge) from P.

P – X = Your Guaranteed Payout

Say you place $100 on a tennis futures bet, with +800 Odds. On the eve of the penultimate game of the tournament, the other player is available at -133 (1.75) odds.

The formula would apply as follows

P = 800

W1 = 100

O = 1.75

X = (800+100) / (1.75)

X = 514.28

800-514.28 = 285.72

If you also bet $514.28 on the opposing player, you’d win $285.72 no matter what. That’s the beauty of hedging!

Hedging is Not Line Shopping (Arbitrage Betting)

Once you’ve wrapped your head around hedging and know how to integrate it into your sports betting strategy, it’s important to remember what hedging is not. Hedging is not line shopping. It has absolutely nothing to do with searching for the best odds and trying to exploit price discrepancies between online sportsbooks.

Hedging is Different for Every Situation

There’s no magic formula to dictate when you should hedge your bet, or when you should abstain from a hedge. Hedging inherently cuts into your profit margins, no matter how you slice it.

This is a never-ending debate in the sports betting community, extending all the way from internet forums to the most successful sharps in sports betting history.

Our best advice? Get comfortable with the different advantages and disadvantages of hedging a bet, and apply this knowledge to your own bets. The suitability of hedges vary based on the situation, and every bettor has their own unique goals, bankroll, and risk tolerance.

Ready for More Sports Betting Strategy?

Risk management is just one element of a comprehensive sports betting strategy. If you want to be more calculated in your approach to betting on sports, the rest of the articles in our sports betting strategy series are an excellent place to start.

Sports & Politics Writer

Aaron has been featured in publications such as Intelligence Magazine, The Investing News Network, Haven, Tech Bullion, and many local and national publications. He has contributed to SBD since 2017. Western B.A. '14, NYU M.A. '17.